download PDF version - To read a PDF file you need to install

Adobe Acrobat Reader:

July 2025

Dear Clients and Friends,

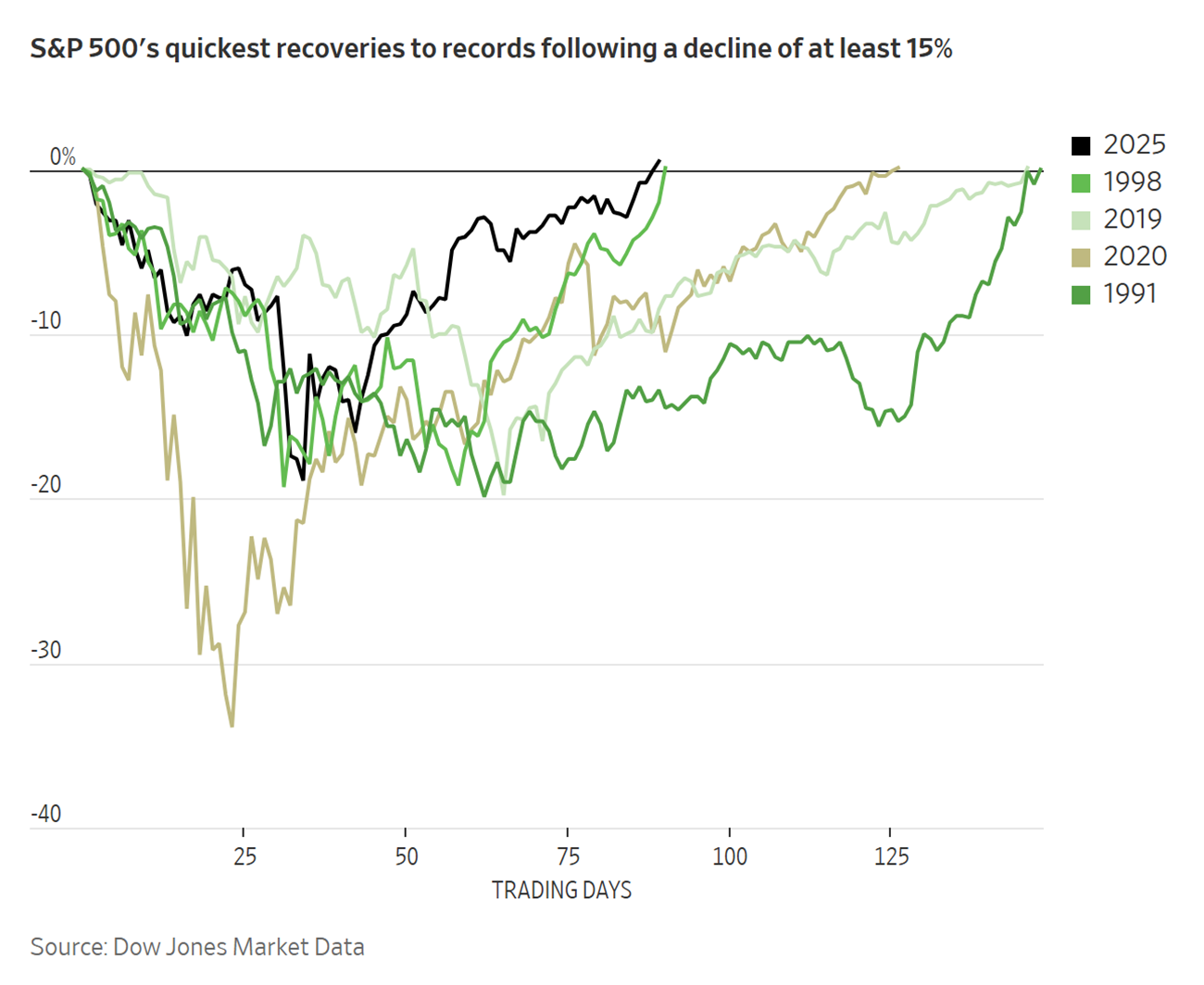

Markets went on a rollercoaster ride in the second quarter with an extraordinary number of events and crosscurrents occurring. President Trump’s “Liberation Day” tariff blitz sent stocks careening lower when the size and breadth of the tariffs was much more than expected. The 15-20% plunge in early April had forecasters calling for a new bear market and a certain economic recession. But a couple of days of near-crisis in select bond markets seemed to lead the President to backtrack on the tariffs. From there, tariff talk mostly cooled, uncertainty ebbed, and stocks launched the fastest rebound in their history (see chart below).

Throughout May and June, tariffs had moved clearly to the backburner. Market participants came to believe that the U.S. and China would avoid significant trade disruption. Investors turned their focus back to when the Federal Reserve will cut interest rates. Trump continues to pressure the Central Bank to ease rates while the Fed points to the unknown impact of tariffs and a possible resumption of growing inflation as a justification for waiting. The market seems to have settled on the first cut in September as of now.

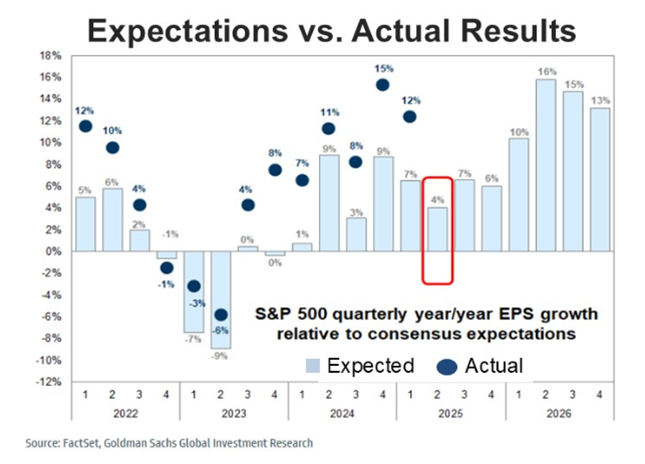

Supporting the rapid market recovery was a strong earnings quarter from the market’s largest companies. The increasingly broad-based strength in earnings also helped investors set aside tariff concerns. While it’s widely believed tariff impacts are yet to come, projections of the overall magnitude have shrunk markedly. This chart shows the substantial earnings growth expected once interest rates begin falling.

While the above topics were the most influential in the second quarter, there was much more for investors to consider. President Trump’s first budget and the preceding work of Elon Musk’s DOGE initiative kept longer-term interest rates higher than they might have been while also pressuring the U.S. dollar to its worst quarter in decades. The budget process also reignited the long-simmering debate about how much debt is too much for the U.S., another factor possibly keeping interest rates higher. Finally, there was the Israeli and U.S. airstrikes on Iran and the Iranian response. That event sent oil prices spiking higher for about a week before they dropped back quickly as the potential for an escalating conflict failed to materialize.

All in all, it was a remarkable quarter for markets with stocks so quickly recovering from near-disaster to achieve fresh record highs. The resilience of investors has been impressive. As the quarter came to an end and the calendar turned to July, the stock market was in full-on bull mode with the rally expanding to include lagging small caps and other higher-risk areas of the market.

Of course, with such a dramatic rebound, stocks have once again become expensive while the impact of tariffs begins to flow through the economy. It’s certainly possible that investors have become too complacent once again and that they are mispricing the risks ahead.

To that end, PIMCO, one of the world’s largest asset managers, in a note to clients, stated that stock valuations are hovering at levels that have “historically preceded major corrections." To their point, looking at the chart below, sales multiples for the S&P500 have now reached a level that has previous augured downturns greater than 20%.

Bespoke Investments noted last week that the 3-month period starting 7/15 is the weakest 3-month period in the year. Their note was bolstered by Fidelity Investment mapping of this year’s returns versus historical returns which indicates that stock indexes are more likely to fall than rise given the recent bounce.

Going into the second half of the year, the bullish case says that the Fed will begin cutting interest rates, inflation will remain tame as tariffs will have a minimal impact, earnings will hold up better than expected and economic growth will remain a solid 2-3%. In short, there will be no notable disruptions to force investors to back off.

The bearish case posits that foundational cracks are beginning to appear in the economy. A weakening labor market will keep consumer spending flat, as it has been for almost a year. The lagged effects of the tariffs will keep inflation stubbornly high, leading the Fed to continue being reluctant to lower interest rates. With bulls relying on lower interest rates as fuel for a second half 2025 rally, markets will fall back.

Regardless of which scenario plays out, we will continue focusing primarily on managing risk in pursuit of returns, especially in such an uncertain environment.

To future profits,

Don Lansing Chief Investment Officer. 512-289-0620 |

Garrett Beauvais Portfolio Manager 512-796-0233 |

download PDF version - To read a PDF file you need to install Adobe Acrobat Reader:

Thank you for your time and interest!

To obtain more information or to schedule a FREE personal consultation so you may fully understand the benefits our clients receive, please contact us at:

| Phone: | (512) 255-8722 |

| Fax: | (512) 255-8732 |

| Email: | info@markettrendadvisors.com |

| Business hours: | Monday through Friday 8:00am to 5:00pm Central Standard Time |

MARKETTREND Advisors, Ltd.

3720 Gattis School Road #800-214

Round Rock, TX 78664-4660

MarketTrend Advisors is an investment advisory firm that specializes in the trend-following strategies outlined in this report. We offer a variety of strategies that can be used to build portfolios to meet almost any investment objective. We divide our strategies into two main groups: "Long" strategies and "Trend" strategies. The Trend strategies follow the trend up or down. The "Long" strategies are typical investment portfolios that usually remain fully invested, potentially raising cash or moving to income-focused investments when the market is weak. We have a variety of "Long" strategies depending on how aggressive or conservative you want to be. These strategies will make their money when the market is moving higher. The "Trend" strategies will provide protection in a down market and add to gains in an up-trending market. By combining the Long and Trend strategies you get all the components needed to build a successful long-term portfolio:

- A portfolio invested in the best performing indexes, ETFs, or stocks

- Substantial exposure to global growth through international holdings

- Protection for your overall portfolio from down-trending markets When the market is going up, you benefit as aggressively as you wish.

Disclaimer

- MarketTrend Advisors, Ltd. is an independent registered in the States of California, Florida, New York and Texas.

- Other Securities Industry Affiliations or Activities. MarketTrend Advisors, is not registered as a broker or dealer, nor do we have any partners or employees who are affiliated with any broker or dealer. See Form ADV, Part II for official declarations.

- MTA portfolio strategies assume risk and no assurance is made that investors will avoid losses. No representation is made that clients will or are likely to achieve profits or incur losses comparable to those shown. Performance results are shown for illustration and discussion purposes only. The performance information has not been audited. However, the information presented is believed to be accurate and fairly presented. All performance figures in this presentation are net of management fees and commissions. Management fees are charged to actual client accounts on a monthly basis. Accounts include both taxable and non-taxable IRA accounts.

- Regarding the MTA Blend strategy: This strategy was migrated into the MTA Wealth Builder strategy and closed in December 2008.

- Regarding actual performance: Actual performance for all strategies includes all commissions as well as management fees (fees range from 1% to 2%). Actual performance statistics are based on the inception date of each strategy through the end of the last business day of the most recent month listed in the monthly performance section of this report. Starting with Q4, 2006, returns include only assets of Fidelity clients who were fully invested in their respective strategies. Returns before Q4, 2006 include all Fidelity client assets regardless of investment status. Results do not include the assets of clients at other brokerage firms.

- Regarding future performance: Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to corresponding past performance levels.

- S&P 500 refers to the Standard & Poor's 500 Large-Cap Corporations Index. The index is designed to measure performance of the broad based US market and consists of 500 American companies. This index is used for comparative purposes only. (Data is taken from Yahoo! Finance.)

- MarketTrend Advisors is not liable for the usefulness, timeliness, accuracy, or suitability of any information contained in its web site or of any of its services. The user understands that the information given can and will fail to predict the direction and magnitude of market price movements and the user can lose money when using this information.