FOLLOW THE TRENDS, FOLLOW THE PROFITS; MARKETTREND ADVISORS LAUNCHED

(September 19, 2005, Austin,

TX) The founders of TimingCube,

a leading online trend following investment method, today announced the formal

launch of a new, separate company MARKETTREND

Advisors, Ltd. (MTA), an SEC registered money management firm. MTA primarily

serves small to mid-size financial firms and Registered Investment Advisors

(RIA), and utilizes the proprietary TimingCube

trend-following model for above market returns while minimizing downside risk.

MTA is one of a few money management firms offering trend following as a core

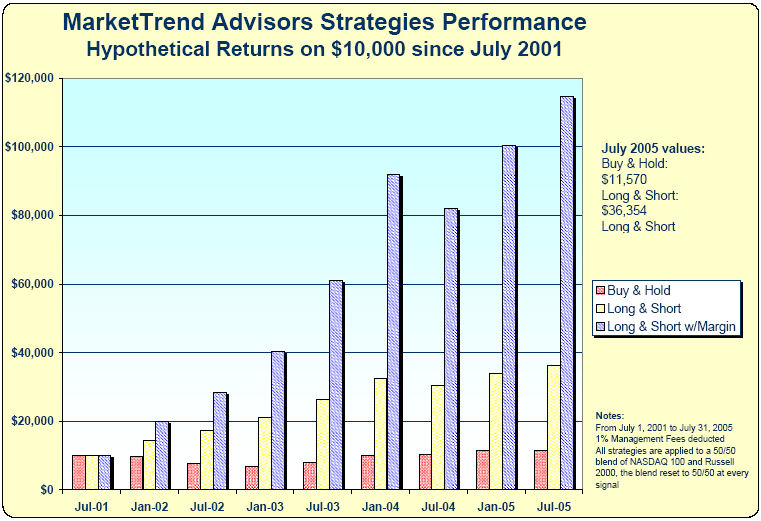

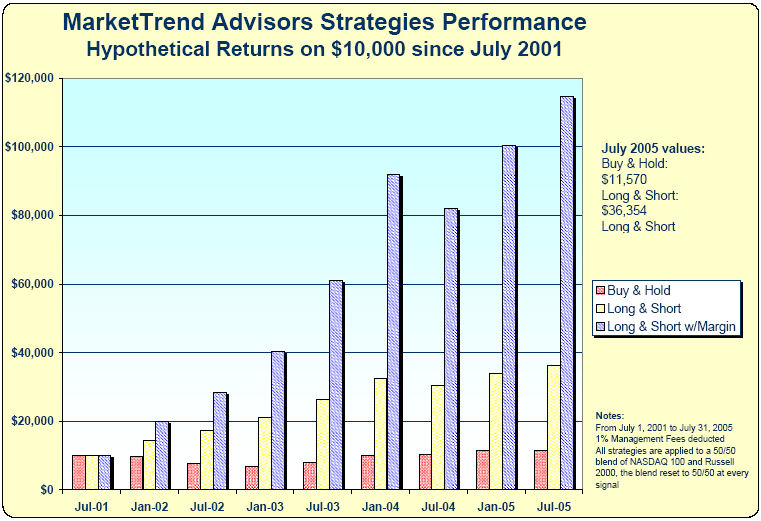

investment strategy. The four-year performance of the TimingCube

investment method shows returns of 264.55% for a long and short strategy versus

a minimal 15.70% gain for a traditional buy and hold position. The long and

short with leverage strategy delivered an outstanding 1,019.34% increase in

the same time period when compared to traditional buy and hold.

"MARKETTREND

Advisors is the full service extension of our 'do-it-yourself' TimingCube

trend-following product. Many professional advisors want to direct a portion

of their client's portfolios to profit from stock market movement both up and

down," said Dr. Serge Dacic, president of MTA.

Varying levels of MTA service are available, depending on the needs of the financial

firm or RIA. Some customers prefer to license the internal signal and handle

the trades themselves, while others want MTA to handle the day-to-day activity

on the accounts. The client's accounts and funds always remain in the custody

of their broker, with MTA only managing the money in the accounts.

"We are very sensitive to the risk tolerance level of investors. By limiting

account exposure to the negative turns in the market, we can consistently deliver

outstanding performance," said Don Lansing, chief investment officer of MTA.

"A substantial number of our clients have dramatically increased their original

assets under our management which speaks volumes about how the system is working

for them."

"As a result, we expect to hit $75 million in assets under management by the

end of the year", said Lansing. "In addition to serving individual clients,

we offer a great turnkey service option for the small to mid-size advisory firms

managing their assets and providing client information materials they can easily

customize."

The internal signal used by MTA was backtested 16 years to 1989 (including four

years of live signals since 2001) where it correctly identified the underlying

trend of the market 86% of the time. During the 14% of the time the model was

wrong, the loss has been held to 2-3% before a quick reversal to follow the

market. "The market's direction cannot be predicted consistently and accurately,

but there are proven trends that, when utilized, reduce an investor's risk and

increase positive returns," adds Dacic.

"We build portfolios one at a time using the goals and risk tolerances of our

clients using exchange-traded funds, mutual funds, stocks, bonds and options

to meet our clients' objectives," said Lansing.

The annual MTA fee structure for licensing the internal signal only is a minimum

$1,000 or .75% of accounts less than three million dollars and drops to .5%

on accounts over that amount. Full service handling of the account by MTA is

1.5% on the first three million dollars, which reduces to 1.25% for accounts

over that amount again with an annual minimum of $1,000.

MARKETTREND

Advisors, currently serves more than 300 accounts with assets of over $50 million.

For more information visit: www.markettrendadvisors.com.

TimingCube,

now entering its fifth year, currently has a count of nearly 5,000 subscribers.

For more information, visit: www.timingcube.com.

Both companies are based in Austin, Texas with a MTA branch in Boston, Massachusetts

to serve clients on the East Coast.

1. For financial professionals only: this release is not intended for further distribution to clients.

2. We are not registered as a broker or dealer, nor do we have any partners or employees who are affiliated with any broker or dealer. See S.E.C. Form ADV, Part II for official declarations.

3. Future Performance: Past hypothetical performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to corresponding past performance levels.

4. All performance data is derived from research and testing the mechanical model back to 2001. Numbers represent a hypothetical return by using market indices traded per the signals. The results are net of fees and transaction costs, but taxes or other costs have not been factored into the results. Results reflect our Long and Short strategy without leverage, and Long and Short with margin, a strategy with leverage.

5. The user assumes all risk. The user understands that the information given can and will fail to predict the direction and magnitude of market price movements and the user can lose money when using this information. The above information does not represent the actual results of client accounts.

#####